The flour milling industry in Nigeria is undergoing a “hot-and-cold” market test. On one hand, a population surpassing 220 million and accelerating urbanization continue to drive stable grain demand. On the other hand, fluctuating raw grain prices, port congestion, and rising energy costs have forced many small and medium-sized milling factories into a “half-operation” or even complete shutdown mode.

For companies looking to invest in building a flour mill plant in Nigeria and purchasing flour milling equipment, this is not a market where you can simply judge at first glance whether it’s “easy or hard to do.” Instead, it’s a track that requires careful balancing of layout, technology, and capital strategies.

Start Wheat / Corn Flour Milling Business in Nigeria

Although Nigeria is an agricultural giant in Africa, its wheat supply is almost entirely dependent on imports. According to FAO and UN Comtrade data, in the past three years Nigeria imported 5–6 million tons of wheat annually, mainly from Russia, the United States, and Canada. Following the Russia–Ukraine conflict, global wheat prices once surged to over USD 450 per ton, while the Nigerian naira depreciated by more than 30% against the U.S. dollar during the same period — creating a “double increase” in raw material costs. This not only squeezed the profit margins of small and medium-sized producers but also increased cash flow pressure.

For local investors, this means your flour mill machine selection and process design must consider raw material adaptability — the ability to flexibly process wheat batches with varying protein contents and moisture levels.

Although more than 150 flour mills are officially registered across the country, industry data shows that about 80% of small factories operate at less than 50% capacity. The reasons are threefold:

This “half-idle” state has prompted some owners to consider selling — creating opportunities for investors in the nigeria flour mill sale market, where you may acquire existing land, factory buildings, and partially installed production lines at a lower cost.

The Nigerian flour market is concentrated among several large groups, such as Dangote Flour Mills and Flour Mills of Nigeria, which together hold over 60% market share. Their plants are mainly located in port cities (Lagos) and trade hubs (Kano). However, profit margins vary significantly:

When choosing a plant location, investors must assess not only transport convenience but also competitive density and the area’s ability to reach regional markets.

If you plan to enter the Nigerian flour milling market, contact our professional engineers to avoid early-stage decision-making blind spots.

160TPD Large Flour Mill Plant Project Installation Site

Building a flour milling factory in Nigeria involves far more than just buying a few machines and placing them in a building.

The protein content, moisture, and impurity levels of imported wheat in Nigeria vary greatly. Many small and medium-sized mills operate with fixed parameters, and when raw grain batches change, they suffer reduced flour extraction rates, increased energy consumption, and unstable flour quality.

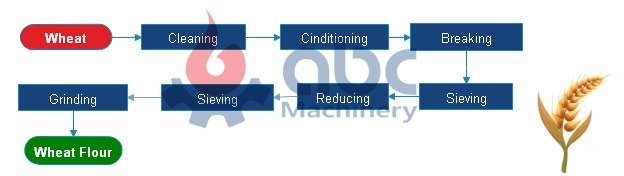

Recommended approach: Leave adjustable margins in the cleaning, tempering, and grinding process steps — for example, using variable-frequency-driven tempering machines, multi-break roller mills, and plansifters with interchangeable sieves. This ensures that even if raw grain specifications change, you can fine-tune the flour mill process to maintain stable output.

Simple Wheat Flour Mill Process Flow Chart

In Nigeria, electricity and diesel are among the largest variable costs for flour mills. Energy-efficient equipment costs more upfront, but the long-term savings in energy bills often offset the price difference.

The table below compares the five-year ROI of energy-saving vs. conventional equipment for a 250 TPD milling unit:

| Item | Energy-Saving Equipment | Conventional Equipment | Difference Analysis |

|---|---|---|---|

| Purchase cost (USD) | 420,000 | 350,000 | 20% higher initial cost |

| Average power consumption (kWh/ton) | 22 | 26 | ~15% energy savings |

| Annual output (tons) | 75,000 | 75,000 | — |

| Electricity cost (USD/kWh) | 0.18 | 0.18 | — |

| Annual electricity cost (USD) | 297,000 | 351,000 | Save 54,000/year |

| Total 5-year operating cost (USD) | 1,485,000 | 1,755,000 | Save 270,000 |

| 5-year ROI | 12% higher than conventional | Baseline | Clear energy advantage |

Data shows that energy-saving equipment has a payback period of about 3.5 years, after which it enters a pure profit phase, whereas conventional equipment carries significantly higher long-term operating costs.

One characteristic of the Nigerian market is large demand fluctuations, especially under the influence of raw grain import policies, global price shifts, and seasonal factors. Launching a large-scale project in one go carries high risks.

If you plan to purchase or upgrade a flour production line in Nigeria, ABC Machinery can provide customizable and scalable solutions — from plant design to equipment configuration — tailored to your budget and target market.

Nigeria is not only Africa’s most populous country but also a core member of the Economic Community of West African States (ECOWAS), enjoying tariff reductions and streamlined customs clearance between member states. This means setting up a plant in Nigeria can supply both the domestic market and nearby countries like Ghana, Niger, Benin, and Chad at low cost.

In practice, many northern mills (such as those in Kano) export part of their capacity to Niger and Chad, while southern plants near Benin use port and road access to sell into Ghana and Togo. Since some neighboring countries lack stable flour production capacity, these cross-border sales often yield higher margins than local sales.

To seize this opportunity, you need to plan ahead for several key points: