Pakistan Flour Milling Industry & Engineering Solutions

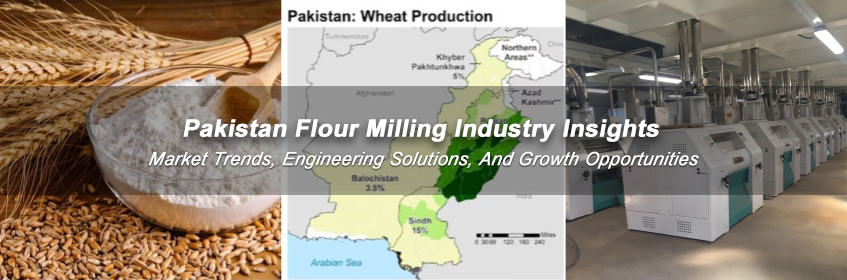

Pakistan’s flour mill sector plays a central role in national food security and industrial supply chains, processing approximately 24–26 million tons of wheat annually. The flour mill industry market has evolved rapidly, driven by population growth, urbanization, and industrial modernization. Between 2020 and 2024, the sector recorded an average annual growth rate of 4.2%, reflecting both rising domestic consumption and export potential.

Wheat accounts for 37% of Pakistan’s total crop output, employing nearly 8 million workers across cultivation, logistics, and milling. The Pakistan flour milling market trends indicate increasing demand for high-protein flour grades for bakery, confectionery, and export products.

In FY2024, Pakistan’s total flour production capacity reached 10.8 million tons, supported by over 1,200 registered mills nationwide, most concentrated in Punjab and Sindh provinces.

| Region | Active Flour Mills | Annual Milling Capacity (Million Tons) |

|---|---|---|

| Punjab | 640 | 5.8 |

| Sindh | 290 | 2.4 |

| Khyber Pakhtunkhwa | 170 | 1.5 |

| Baluchistan | 100 | 1.1 |

The wheat flour processing growth in Pakistan has been supported by public-private partnerships and investments in modern roller mills, enabling efficiency improvements of up to 18% in energy use per ton of output. Moreover, the introduction of digital grain tracking and blending systems has improved product consistency and quality grading accuracy by approximately 12%.

Government interventions through the Wheat Import Quota Program and Subsidized Flour Scheme have created opportunities and constraints for millers. Import tariffs fluctuated between 5–10% in 2023, affecting raw wheat availability and pricing.

However, localization initiatives—especially in the Punjab Food Industry Development Plan 2030—aim to reduce import dependency and promote domestic machinery manufacturing. This initiative is expected to add USD 80 million in new local equipment sales within three years.

Partner with us to transform your flour mill operation through data-driven engineering solutions tailored for Pakistan’s growing milling market.

A Small to Medium Wheat Flour Mill Plant Setup

Establishing a flour mill in Pakistan requires careful assessment of site location, capacity planning, and budget optimization. The flour mill industry market attracts investors due to rising domestic consumption—estimated at 135 kg of flour per capita annually—and stable demand elasticity.

Typical investment in a medium-scale flour mill plant investment in Pakistan ranges from USD 1.8–2.5 million, with expected ROI periods of 4–6 years under efficient management.

Proximity to wheat production zones (e.g., Multan, Faisalabad) reduces logistics costs by 8–12%, enhancing profitability. The optimal capacity for a regional plant is between 100–150 tons/day, balancing production flexibility with capital efficiency. (Read More: Choose the Best Location for your Flour Mill Plant>>)

Main equipment includes roller mills, sifters, purifiers, and packaging systems. Energy costs account for approximately 25% of total operating expenses, while labor contributes around 18%. Automation solutions can reduce labor costs by up to 30% and improve output stability.

Get Your Customized Flour Mill Investment Feasibility Report – Contact Our Engineering Consultants Today.

The modernization of flour mill in Pakistan facilities relies heavily on advanced flour milling process design and integrated automation systems. Plants adopting automated batching, digital monitoring, and predictive maintenance technologies achieve up to 25% higher throughput and 20% lower downtime.

Process flow design in Pakistan’s mills typically includes cleaning, conditioning, grinding, sifting, and packaging. Optimized plant layouts minimize material loss and streamline operations.

| Process Stage | Energy Use (kWh/Ton) | Improvement Potential (%) |

|---|---|---|

| Cleaning | 18 | 10 |

| Grinding | 42 | 15 |

| Sifting | 15 | 12 |

| Packing | 10 | 8 |

Adopting computerized SCADA (Supervisory Control and Data Acquisition) and PLC (Programmable Logic Controller) systems allows real-time production monitoring and predictive fault alerts. These systems reduce maintenance costs by 14–18% annually and support remote diagnostics, improving uptime consistency across all shifts.

Wheat Flour Milling Process in Automatic Plant: Cleaning, Grinding, Sifting, Packaing Machine

Modern flour mill automation systems integrate Near-Infrared Reflectance (NIR) sensors for quality monitoring, reducing manual testing intervals from 2 hours to 15 minutes. Pneumatic conveying systems powered by frequency-controlled fans cut power consumption by up to 22%.

Unlock production excellence and energy savings – Connect with our engineering experts for a tailored flour production line engineering solution today.

The flour mill industry market continues to evolve amid challenges in raw material pricing, logistics, and technology adaptation.

Volatility in wheat prices—ranging from PKR 4,200 to PKR 6,000 per 40kg in 2024—remains a major concern for local millers. Disruptions in the wheat supply chain in Pakistan can lead to profit margin fluctuations of up to 8% monthly. Meanwhile, food safety compliance (ISO 22000, HACCP) pushes mills to adopt stricter quality protocols and enhanced traceability systems.

Emerging flour mill technology development trends focus on digitalization and renewable energy integration. Hybrid-powered mills using solar-assisted drives report 12–15% reductions in total power cost. Furthermore, sensor-based quality inspection systems now achieve 95% grading accuracy, compared to 82% using traditional manual testing.

Partner with us to design the next-generation flour mill in Pakistan, built on efficiency, automation, and sustainable innovation.

flour mill in pakistan solutions continue to underpin Pakistan’s industrial and food production growth. The flour mill industry market demonstrates consistent expansion potential supported by technology-driven process upgrades and local manufacturing.