The flour mill industry is a vital part of global food security, producing more than 400 million metric tons of flour every year. In this series, we break down complex data into clear, practical guidance—helping investors and project planners understand flour mill market trends, design efficient plants, and make informed decisions.

From in-depth looks at country-specific market opportunities to best practices in flour mill plant design and cost control, each article dives into a focused topic so you can explore this USD 270+ billion sector from every angle—step by step, and market by market.

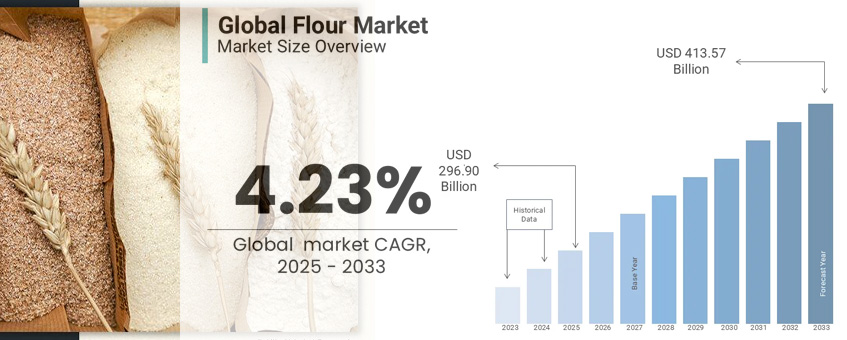

The global flour milling market is valued at around USD 275 billion in 2024, growing at a steady 3.6% CAGR through 2030. Asia-Pacific leads production with over 45% market share, while Africa is the fastest-growing region at 5% annually. Global flour grinding market trends show increasing demand for both staple and specialty flours. (Read More: Column - Flour Production Market Trends in Many Countries>>)

For investors, key wheat and maize flour milling investment opportunities lie in aligning product types with regional consumption habits, adopting energy-efficient technology, and designing flexible capacity plants. Matching supply to local demand can shorten ROI periods to 4–6 years.

Growing Market - Start A Profitable Flour Mill Plant Business Today

From South Asia to Sub-Saharan Africa, demand for wheat and maize flour is growing faster than local supply chains can keep up. Many countries are upgrading milling technology to improve yield, cut losses, and meet rising consumer expectations for quality. The growth potential varies widely between countries, making localized strategy essential.

Pakistan processes over 25 million metric tons of wheat annually, but demand still outpaces supply in some regions. Most mills operate at 50–200 tons/day capacity, creating opportunities for modern plants with higher efficiency. Policies favor domestic wheat use, and urban bread consumption is driving premium flour demand. Investors can gain market share by introducing automatic flour milling systems that cut production losses by 8–10%.

Setup a Flour Mill Plant in Pakistan>>

Ethiopia’s wheat flour demand is rising at about 6% per year. Government import programs and subsidies encourage private sector participation in milling. Local production covers roughly 70% of needs, leaving space for efficient new plants. Regional flour demand analysis shows that premium flour production for bakery use is an emerging niche. (You may interested in: A Wheat Flour Mill Business Plan Sample in Ethiopia PDF>>)

Kenya consumes over 1.7 million metric tons of maize flour annually, alongside a steady demand for wheat flour. Urbanization is fueling packaged flour growth. Investors should note that maize mill machines in rural areas often run at 50–60% capacity due to outdated maize mill machines—upgrading can boost yield by 12–15%.

Nigeria’s flour production market is valued at over USD 3 billion, with demand for both bread flour and semolina. South Africa’s maize milling sector offers profit potential through regional exports, with maize flour prices up 7% in the past year. Positioning a grain mill in these hubs enables access to multiple regional markets, reducing dependence on a single domestic demand source.

India’s small flour mill businesses thrive in rural zones where local demand is strong but supply chains are short. Uganda’s maize flour market is expanding, and current maize milling machine price in Uganda trends suggest opportunities for cost-efficient equipment imports.

Tell us your target country, grains types, and capacity goals—our engineers will design a customized flour mill plant blueprint that fits your market and maximizes your returns.

| Country / Region | Annual Production (MMT) | Growth Rate (CAGR) | Key Investment Opportunity |

|---|---|---|---|

| Pakistan | 25+ (wheat) | 2–3% | Modern automated plants to reduce losses |

| Ethiopia | ~6 (wheat) | 6% | High-efficiency mills for import substitution |

| Kenya | 1.7 (maize flour) + wheat | 4% | Upgrading rural mills, packaged flour market |

| Nigeria | ~6 (wheat & semolina) | 5% | Large-scale plants with regional export reach |

| South Africa | 2.5 (maize) | 3% | Export-oriented maize milling |

| India | 90+ (wheat) | 1.5% | Small-to-medium plants in rural areas |

| Uganda | ~1.2 (maize flour) | 4.5% | Affordable milling equipment imports |

Anyang Best Complete Machinery Engineering Co., Ltd (ABC Machinery) provides complete end-to-end solutions for the global flour milling industry—covering feasibility studies, customized plant design, equipment supply, installation, and commissioning. With successful projects in 40+ countries and capacities from 20 to 1,000 TPD, we ensure every plant is optimized for its target market, meets local regulations, and integrates the latest energy-saving technologies.

New Zealand Large Industrial Flour Mill Plant Project

A well-planned flour mill layout is key to maximizing output and minimizing costs. For example, a 200 TPD facility typically requires 1,500–2,000 m², with workflow arrangements that reduce material handling. Our engineering team helps you select the ideal equipment to achieve these goals, including:

Whether you’re building a new factory or upgrading an existing one, ABC Machinery delivers integrated plant construction and machine solutions. Contact ABC Machinery today to turn your flour milling investment vision into a high-performing reality.